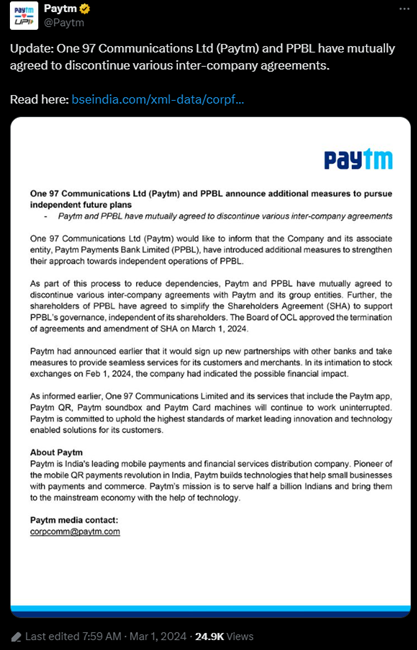

Paytm has announced that it has decided to end several agreements with Paytm Payments Bank (PPBL) in a mutual decision. The move comes as both companies aim to strengthen PPBL’s independent operations.

Aligning with Regulatory Directives

This decision is in line with the Reserve Bank of India’s directive to halt basic banking services by March 16. Paytm had previously announced plans to forge new partnerships with other banks to ensure seamless services for its customers and merchants.

The company had also hinted at the potential financial impact of these changes in its communication to stock exchanges on February 1, 2024.

Mutual Agreement and Board Approval

Both Paytm and PPBL have mutually agreed to discontinue various intercompany agreements and simplify the Shareholders Agreement (SHA) to bolster PPBL’s governance independently.

The board of Paytm’s parent company, One 97 Communications Limited, has formally approved these terminations and amendments on March 1, 2024.

Continuity of Paytm Services

Despite these changes, services provided by One 97 Communications Limited, including the Paytm app, Paytm QR, Paytm soundbox, and Paytm Card machines, will continue without interruption.

Paytm has moved its nodal account to Axis Bank last month, ensuring seamless operations. Paytm emphasizes its commitment to maintaining high standards of innovation and technology-driven solutions for its customers.

Announcing the update, Paytm posted:

One 97 Communications Ltd (Paytm) would like to inform that the company and its associate entity, Paytm Payments Bank Limited (PPBL), have implemented additional measures to fortify their approach towards enhancing the independent operations of PPBL.

#Paytm #ends #intercompany #agreements #Paytm #Payments #Bank #ahead #RBI #deadline

Comments